Automation Anxiety in an Age of Stagnation (American Affairs, Summer 2019)

by Rian Whitton

Acursory glance at Google Trends reveals that interest in robotics and automation was far less intense throughout the last decade than interest in proposed solutions to the problems that these technologies are supposedly creating, especially universal basic income (UBI). Automation—the process of applying technology and organization to do more with less, with robotics being its most identifiable manifestation—has become a key topic in the sprawling soap opera of American politics, yet the phenomenon itself is not really understood, discussed, or debated.

The usual self-proclaimed experts have clearly defined opinions on this issue. The pamphlets of the World Economic Forum (WEF) continually emphasize that the acceleration of technological change and the resulting effects, whether mass unemployment or the inability of national regulators to keep pace with innovation, reinforce the need for “centrist” institutions like the WEF—institutions that are increasingly being weakened by resurgent nationalisms and competing ideologies.

The Davos crowd takes for granted that the U.S. economy is experiencing extraordinary levels of automation and that this is the leading factor behind dislocations in various regions and sectors, as opposed to, say, trade policy or offshoring. Unwilling to question either of these assumptions, metropolitan orthodoxy is increasingly turning to UBI as the only solution to problems such as wage stagnation and the mass unemployment expected in the not-so-distant future.

For example, Bill Gates, a moderate by most measures, and Elon Musk, the tycoon-provocateur, have both indicated their belief in the unstoppable rise of artificial intelligence and job-killing automation, and hence the need for a UBI. Gates, in particular, stressed the need for a tax on capital equipment that would fall under the nebulous description of robotics. As far as both are concerned, artificial intelligence and robotics stand to make large portions of the workforce redundant, and the only question left is how to mitigate the impact.

Within the Democratic Party, the highest-profile speakers on this issue are Alexandria Ocasio-Cortez and Andrew Yang. Ocasio-Cortez has staked out a position as the interlocuter between old-school democratic socialism and the culturally “woke” urban elite wings of the American Left. During the most recent South by Southwest event, she emphasized that automation did not have to be painful; it is the low value society places on not working and the reluctance to impose significant taxes on capital spending (e.g. Bill Gates’s robot tax) that are the problems.

The second, perhaps more interesting case is Andrew Yang, the outsider presidential candidate. Yang manages to circumvent the tired culture-war talking points of most other Democrats and ignores old media for popular and non-adversarial platforms like the Joe Rogan podcast. He also discusses issues that attract attention among disproportionately influential internet subcultures, with praise coming from the Left, classical liberals, and the new Right. His affable nature and interest in big solutions, alongside his acknowledgment of globalism’s failures, endears him even to some of President Trump’s early supporters, who have become disaffected with an administration that is less and less distinguishable from establishment Republicans.

Yet Yang’s arguments are actually very similar to President Obama’s warning about automation in his 2016 farewell address. (The two even had a previous relationship, with Yang selected as a “Champion of Change” in 2012 and a “Presidential Ambassador for Global Entrepreneurship” in 2015.) Both argue that automation is destroying too many jobs, making people resentful and causing them to blame immigrants and global trade. In fact, their assessment that automation is deindustrializing the country more than globalization is inaccurate, but the counterargument has not yet gained sufficient traction among the expert class.

UBI is also gathering support among more hard-line Marxists. A fully automated society can pair nicely with communist utopia, with both often described as inevitable even when they are historically unprecedented. An increasing number of socialists today, particularly in the United Kingdom, believe that technology can provide the necessary bridge to a utopia with no work or want. But the idea of universal luxury is tenuous given that luxury is a positional term, and thus is by definition unattainable for most of the population. If the baby boomer desire to find authenticity and break through bourgeois orthodoxy rested on everyone’s desire to be different (and in the end looking very much the same), the pursuit of egalitarian leisure similarly rests on the assumption that everyone can attain above-average wealth. Such hopes will lead to similar disappointment.

As for the Republicans, while the trade hawks of the Trump administration talk frequently of the threat of China’s massive industrial expansion, they tend to speak little about robotics. And while Republicans have attacked speculative proposals like the Green New Deal, they have shown little interest in offering an effective alternative for a broad-based, technology-focused investment push. Nor has there been much of an attempt to rebut Yang’s arguments on automation. As for President Trump himself, although his irreverence toward the political establishment is opening new ground for discussions, his rhetorical adventurism does not extend to generating new solutions. He has stumbled into well-known discussions, notably regarding the automation of piloting, but shows little interest in pursuing an alternative narrative to that of his opponents. The fact that the current U.S. Chief Technology Officer, Michael Kratsios, was only nominated in March 2019 indicates a lack of prioritization.

If anything, the more dynamic elements of conservatism accept the central premises of the popular automation consensus. Tucker Carlson, who has frequently voiced desires to move beyond conservatism’s stale economic orthodoxies, did not push back on Yang’s premise that automation is going to create massive unemployment. Yang even mentioned in his interview with Carlson that automation destroyed four million factory jobs in the Midwest, though this patently contradicts a mountain of evidence, which stresses the primary importance of China’s accession to the WTO in hollowing out both high- and low-value-added U.S. manufacturing since 2000.

In short, across the political spectrum there has been far more interest in discussing reactive measures to address the secondary effects of automation, rather than investigate the nature and consequences of automation itself. And there has been little effort from either party toward developing a comprehensive automation strategy to energize U.S. manufacturing. But such a strategy should be the first priority. Whether it comes from the Right or the Left, there needs to be a more rigorous understanding of robotics and automation, what it has done to U.S. industry, how impactful it will be in the foreseeable future, and who will benefit if America does not pursue an automation strategy.

Is Automation the Problem?

Robotics helped Trump win. That is what Carl Frey, economist and scholar of automation, argued in a 2017 analysis of robotics and voting patterns in 2016.1 He went so far as to argue that, “At a 10% lower robot exposure, Michigan would have swung in favour of Clinton.”2 These are fine margins indeed—we are talking about just thousands of machines.

That such speculations are quoted as gospel in the MIT Technology Review is itself a problem. These conjectures are based on Frey and Michael Osbourne’s 2013 paper that has come to define the debate on robots and automation’s impact on society. The projections they laid out were daunting, with the authors suggesting that up to 47 percent of U.S. jobs and 35 percent of UK jobs were at risk of automation through 2035. More than any other study, Frey and Osborne’s analysis formed the basis for a number of public reports, including one from the Bank of England.

In the years since, however, there have been multiple studies contradicting the findings of Frey and Osbourne, with two coming from the Organisation for Economic Co-operation and Development (OECD).3 Both OECD studies found the risk of automation to be significantly lower, with the first study finding only 9 percent of jobs at risk of automation across the OECD. The second found that 10 percent of jobs in the United States were at high risk, while 12 percent of British jobs were at high risk.

A major reason for the disparity was that the OECD studies broke jobs down into tasks and considered not just whether technology could hypothetically automate a task but whether it would be profitable. Frey and Osbourne’s 2013 paper did not analyze the issue at this level of granularity.

But even when such counterarguments surfaced, they were not disseminated with anything like the same fanfare as the original narrative which matched elite expectations. In fact, no amount of evidence to the contrary has dented the apparent irresistibility of the mass-automation-unemployment argument for decades. Dire warnings of mass joblessness were being sent to President Johnson as early as 1964.4

The mainstream media has also frequently promoted the standard establishment talking points arguing that anyone pointing to trade rather than automation as the source of job losses “simply does not understand economics.” This is a popular message among the punditariat, to the point where publications like the New York Times misrepresent academic studies to propagate the notion that U.S. manufacturing employment was not destroyed by the China shock but by rapid technological innovation.5 The Economic Policy Institute (EPI) highlighted one instance in which the Times referenced a 2017 paper by economists Daron Acemoglu and Pascual Restrepo to assert that automation was responsible for the majority of the decline in manufacturing employment over the last fifteen years. Restrepo and Acemoglu’s work actually indicated that robotics led to a mild decrease in U.S. employment (670,000 jobs between 1990 and 2007, or 40,000 jobs each year, a 0.34 percent decline in the share of the working age population with a job).6 In the same report, the two economists actually found that Chinese accession to the WTO had at least three times the negative impact of robotics, contradicting the way the paper was presented in the Times.7

Acemoglu and Restrepo also found that capital investments as a whole (including non-robot IT) were neutral in regard to their effect on employment.8 Josh Bivens of EPI asserts that there is near zero evidence that robots displace jobs or significantly lower wages, with much more evidence pointing to offshoring and reduced bargaining power for unions.9 Further work from the Information Technology and Innovation Foundation finds that the churn of jobs lost and gained by technological disruption has been at a record low in the United States.10

Regardless of whether the impact of robotics on U.S. employment was incrementally negative or positive, a scholarly consensus is emerging that it was dwarfed by the offshoring of jobs to China following WTO accession. Another study coauthored by Acemoglu found that competition with Chinese imports cost the United States 2.4 million manufacturing jobs between 1999 and 2011.11

In addition, the argument that robots were the main culprit in the decline of U.S. manufacturing employment is not substantiated by what was actually happening in U.S. robotics, nor is it consistent with the experience of other countries. U.S. manufacturing jobs plummeted from over 17 million in 2000—when China joined the WTO and the bipartisan consensus in favour of trade liberalization was at its strongest—to under 12 million in 2010. (The number stood at 12.7 million in 2018.) Were it the case that these losses were mainly the result of automation, why did a 33 percent loss in manufacturing jobs from 2000 to 2014 coincide with a 22 percent decrease in the number of manufacturing plants? Presumably, replacing labor with capital equipment might lead to some efficiencies in the closure of brownfield sites, but these large machines still have to work somewhere.

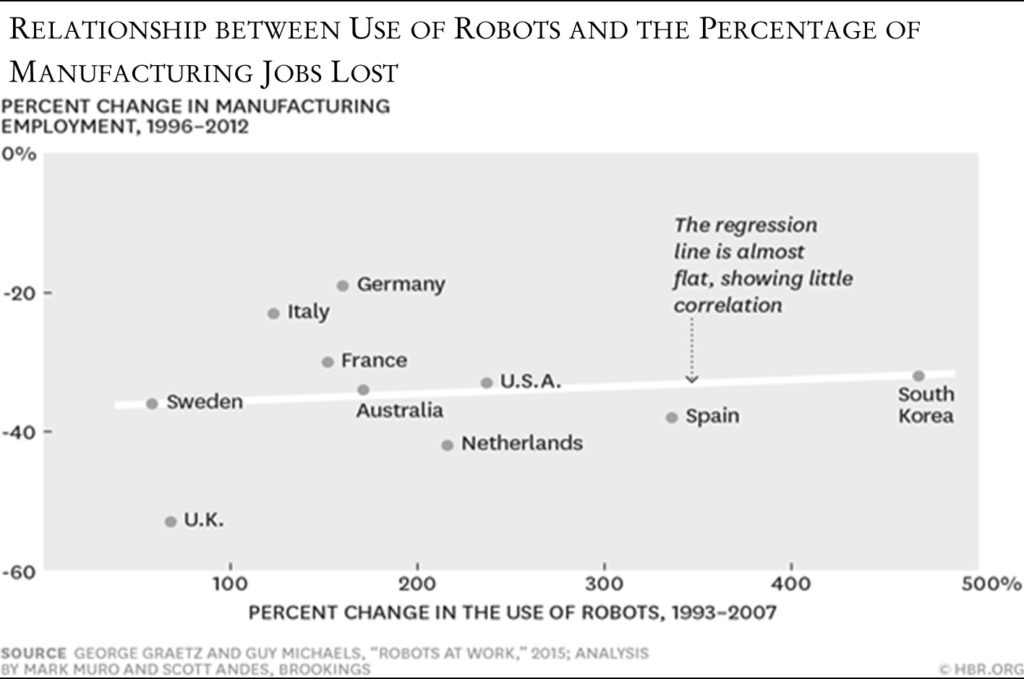

The assumed correlation between robotics deployment and losses in manufacturing jobs becomes even more tenuous when one considers countries other than the United States. A 2015 Brookings analysis finds a small negative correlation between growth in robotics adoption and job loss. Take the United Kingdom, whose use of robotics has been paltry in comparison to other European countries, and whose manufacturing employment decreased by over 50 percent between 1993 and 2007. By contrast, Germany’s manufacturing employment decreased by less than 20 percent during the same period, despite adding significantly more robots. (Most countries lost some employment during this period due to supply chains shifting in favor of China and the developing world.) Inhibiting or simply being apathetic about capital investment and automation will not save a country’s workers from unemployment; it will more likely cause them to lose further ground in an increasingly competitive manufacturing environment.

And if robots are causing the decline in manufacturing employment, how can 2018 be explained? U.S. manufacturing employment surged by 284,000 new payrolls last year, the largest percentage increase since 1984 (around 2 percent). At the same time, the Association for Advancing Automation reported that 2018 saw a record deployment of industrial robots, particularly in sectors other than automotive, where robotic density is already high. According to the Robotic Industries Association (RIA), robot shipments to North American companies grew 7 percent in 2018 compared to the previous year, with a 41 percent increase in shipments to non-automotive companies.

Specifically, the RIA said 35,880 units were shipped in 2018, with 16,702 of those shipments being sent to nonautomotive firms.12 In this instance, increased shipments of robotics are correlated with higher growth rates in manufacturing employment. A counterargument might be that employment is shifting from easily replaceable production jobs to management, but as Manhattan Institute fellow Oren Cass notes, the ratio of production workers to managers has been remarkably stable for decades.13

Deindustrialization, Not Automation, Is the Problem

If robotics do not have a significant negative effect on employment, then what has been ailing the U.S. economy? Contrary to elite conventional wisdom, it is the opposite of too much automation: key industries have experienced long-term stagnation, and America is losing the ability to compete in critical technology subsectors.

Establishment commentators still insist that the main losers of the 2000s were low-value-added sectors like apparel, and despite lower job numbers, productivity has risen due to automation and capital investment, in essence making the United States more competitive than ever. Neoliberals and free traders assert that nothing would have stopped the loss of jobs to China and that their value was minimal. But this view is contradicted by numerous metrics.

First, consider the scale of the decline. In 2000, the United States produced about 18 percent of the world’s manufactured exports; by 2012, that number had fallen by half, to around 9 percent. Even relative to the EU and Japan, the U.S. decline has been precipitous. During the same period, China’s share rose from about 5 percent to 18 percent.14

Furthermore, the United States has become a net importer of high‑technology products. A 2015 report by the Brookings Institution found that the United States ran a $632 billion trade deficit in advanced industries in 2012.15 This is not what one would expect in a country that is supposed to be replacing low-value industries with high-value ones.

Productivity cannot be the answer, either. The idea that robots are putting people out of work presumes that declining job numbers are due to productivity growth. But gains in U.S. labor productivity have slowed in recent years. Between 1995 and 2002, labor productivity growth was 3.3 percent, according to the Federal Reserve Bank of San Francisco, while from 2007 to 2016 productivity growth was just 1.3 percent. When considering manufacturing productivity in the United States, the decline is even more pronounced in recent years, with multifactor productivity declining 0.8 percent between 2007 and 2016, according to the Bureau of Labor Statistics (BLS).16

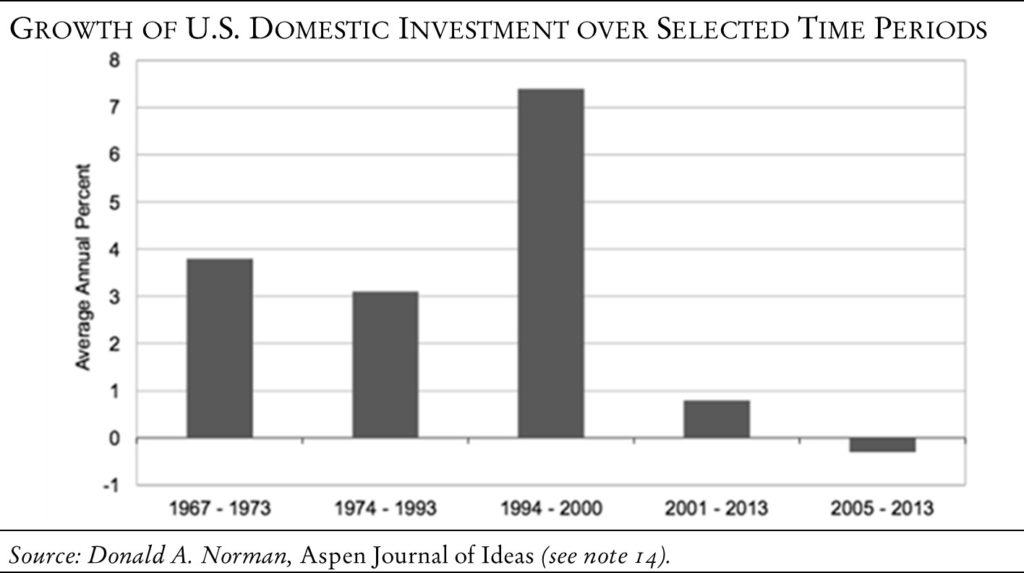

The slowdown in productivity growth also correlates with the slowdown in capital investment growth across both hardware and software. Domestic investment in the wider U.S. economy averaged annual growth of over 7 percent between 1994 and 2000, but posted annual growth of under 1 percent from 2001 to 2013, according to the Aspen Journal of Ideas.17 This is not what one would expect in an economy replacing workers with machines. The post–Cold War consensus that shareholder capitalism would generate improved capital investment did work for a short time, but it has clearly brought diminishing returns in recent decades, and even declines in domestic investment growth after the Great Recession.18

BLS data provides further insight. The information economy which was promised has not materialized. The share of high-tech output and employment in the United States has been stagnant for decades, a trend that is projected to continue.

The United States is also losing its edge to competitors in standard measures of innovation. As Brookings notes, the U.S. share of global R&D and patenting is falling faster than its share of global GDP and population, meaning that U.S. slippage cannot simply be attributed to demography or macroeconomic convergence.19

This story is certainly true for nonfederal R&D spending. While business R&D investment in the United States jumped from $328 billion in 2000 to $458 billion in 2016 on an inflation-adjusted basis, the rate of R&D growth as a share of GDP over the same period has basically been flat—inching up from 2.61 percent to 2.74 percent. If your economy is dependent on innovation as opposed to the low-hanging fruit of a growing labor force, this is insufficient. Moreover, businesses are investing a much smaller share of their revenues in riskier, early-stage basic and applied research than in later-stage development, and the global share of business R&D performed in the United States has fallen significantly in the last decade.20

Anemic growth in private sector R&D is troubling as it was supposed to compensate for stagnation in government R&D spending. In the 1960s, U.S. government R&D funding exceeded the rest of the world (public and private) combined. But since peaking in the late 1980s at 1.2 percent of GDP, U.S. government R&D has fallen to 0.8 percent of GDP.

Anemic growth in private sector R&D is troubling as it was supposed to compensate for stagnation in government R&D spending. In the 1960s, U.S. government R&D funding exceeded the rest of the world (public and private) combined. But since peaking in the late 1980s at 1.2 percent of GDP, U.S. government R&D has fallen to 0.8 percent of GDP.

As with robotic adoption, the United States is experiencing stagnation while competitor economies undergo massive expansion. Although U.S. federal R&D increased by 3 percent from 2000 to 2012, China’s increased by 110 percent. Without significant change, the relative decline of America’s historic advantage in technological innovation will continue.

Stagnant capital and R&D investment, low productivity growth, and backsliding in the face of increased competition (notably from China) are the primary reasons for stagnant U.S. manufacturing, and this can be seen when focusing on output, which has increased by only 8 percent since 2000, nineteen years ago. There has not been a comparable period of stagnation in American manufacturing in the modern era. Where there has been extensive growth has been in computers and electronics. But even this supposed bright spot has been heavily overstated through the use of arcane statistical jiggery-pokery.

Susan Houseman of the Upjohn Institute has found that the current measure of output does not merely account for the number of semiconductors or computers produced, but increases alongside their quality, so while the number of products produced could stay the same, or even decline, the output technically goes up.21 This, in effect, has provided the illusion of growth in manufacturing when, in fact, productivity growth, employment, and share of global exports (including high-tech) are all down significantly from their peak in the immediate aftermath of the Cold War. With all this in mind, the fact that, in today’s political rhetoric, fear of automation supersedes fear of America being leapfrogged by other nations becomes all the more baffling.

Closing the Automation Gap

While robots are almost always identified as one of the problems facing U.S. employment, they are actually part of the solution. With improved returns on investment, higher productivity, and greater ability to compete on the global stage, companies that have high robotic density are much better prepared for the global manufacturing environment of the next decade. Robotics are also critical to the much-touted but as yet unrealized aspiration to reshore manufacturing operations to the United States.

Moreover, robotics are an end-point technology, combining computer science, mechatronics, advanced machinery, electronics, and connectivity into high-value-added platforms. This creates very high barriers to entry when it comes to deploying and producing new robotic solutions, and those countries that develop these capabilities will have a strategic advantage for the foreseeable future.

As noted, the United States is something of a laggard in this space, especially when accounting for its enormous research and innovation pedigree. Overall, there are estimated to be 260,000 industrial robots deployed here, with a majority being located in the Midwest and upper South, the regions with the highest concentration of automotive manufacturing operations. Compared to America’s top-tier competitors, these numbers are modest.

From 2008 to 2017, the annual supply of industrial robots in the United States increased by an average of about 24,000 per year (219,000 in total). This growth has been faster than Germany in absolute terms, where annual supply increased by between 20,000 and 22,000 per year, but Germany is a much smaller economy. U.S. GDP is about five times that of Germany, and the U.S. population is almost four times Germany’s. In South Korea, an economy about one-twelfth the size of America’s, annual robot installations increased from 12,000 in 2008 to 39,000 in 2017.

When accounting for robot density (the number of industrial robots per 10,000 manufacturing workers), the United States also lags behind South Korea, Japan, Germany, and other countries. This is gradually changing, as 2018 saw a significant acceleration in deployments of robots in nonautomotive industries, suggesting that America could gradually gain ground.

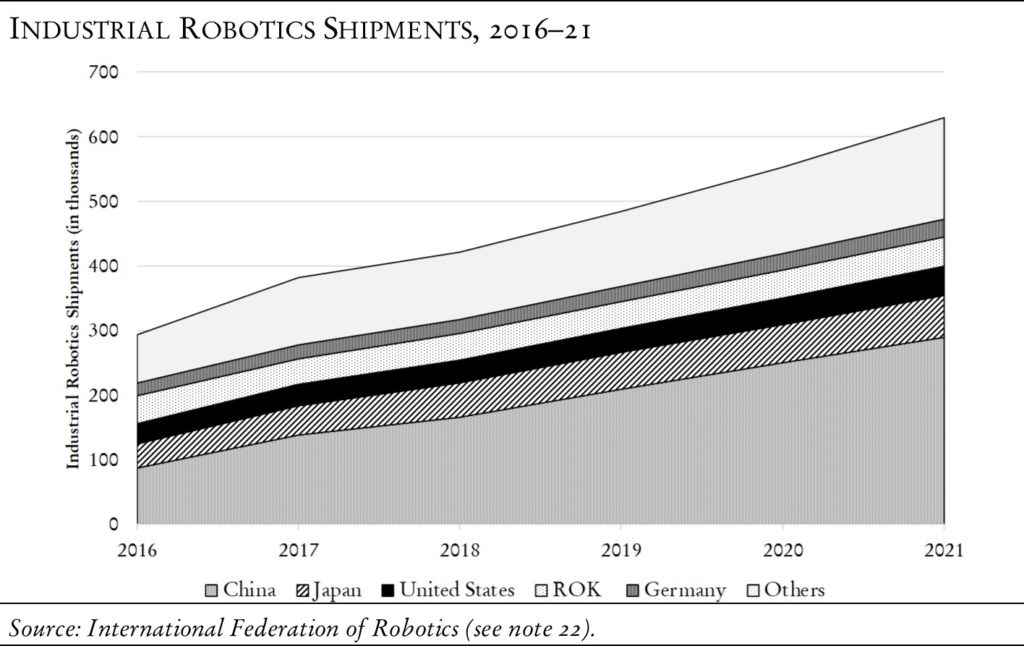

But when controlling for wages, the Information Technology and Innovation Foundation (ITIF) has highlighted that the United States has been lagging behind East Asian companies for years. Industrial robots being expensive pieces of capital equipment, the return on investment is quicker when wages are higher. Controlling for wage levels, ITIF found that the United States is deploying 49 percent fewer robots than expected, while China is deploying 153 percent more than expected. Again, it appears that American capital investment is not adequate to meet the country’s competitive challenges. Going forward, the International Federation of Robotics (IFR) forecasts that U.S. shipments of industrial robots will increase, but they will be modest compared to the global picture, with China being the clear front-runner.22

Altogether, the United States significantly lags behind its key manufacturing competitors, including China, Germany, Korea, and Japan in industrial robotics deployment. This is not to say that the United States does not have advantages in other areas of technology, notably an ecosystem of manufacturing providers who have some of the most advanced cloud and Internet of Things (IoT) competencies. And the United States is still a leader in many nonindustrial robotics applications. In the mobile robotics space, Amazon is deploying automated guided vehicles across its warehouses and distribution centers at scale, and when it comes to competencies like simultaneous localization and mapping (SLAM) to develop autonomous vehicles, the U.S. ecosystem remains the strongest.

Other advanced capabilities like deep-learning-enabled machine vision and advanced motion control are still being pioneered by U.S. companies. More nascent markets for robotics like exoskeletons also represent an area where the United States can rely on its higher education apparatus. That being said, Americans pioneered the first robotics company, Unimation, but were unable to translate this innovation into development. Innovation alone, without the right manufacturing ecosystem, is not always enough to create successful industries. A more comprehensive strategy is required.

Drone Wars: A Case Study in the Deficiences of the American Innovation Model

The case of the consumer and commercial drone industry highlights the ability of Chinese companies to outcompete their U.S. rivals and take majority market share across the world, even in fairly new technology opportunities like commercial unmanned aerial systems. Although the United States was the first to deploy unmanned aerial systems, China’s drone industry has now surpassed America’s by most measures. America may still have advantages in cutting-edge defense drone technologies, but China has captured entire technology markets indirectly related to the military, like small unmanned aerial systems (below twenty-five pounds). DJI, the Shenzhen-based developer of high-end consumer and commercial drones, has close to 80 percent of the global consumer drone market.

Meanwhile, an American drone manufacturer that was hoping to compete with DJI, 3D Robotics (3DR), failed. The reason behind this failure was not simply price point or design, but quality. American drones like the 3DR’s Solo and GoPro’s Karma, burdened with go-to-market issues, were both retired promptly, while DJI’s products are of sufficient quality to be used in mining, construction, and other industry verticals. What allowed the Chinese company to develop a superior product was that DJI’s assets—manufacturing, design, and management—were all located in Shenzhen, allowing shorter R&D cycles and improved organization. By contrast, 3DR and other American competitors had their headquarters in Palo Alto and their factories in Tijuana. Control of the value chain in effect gave Chinese hardware companies a massive competitive advantage over Silicon Valley, to the point where one iteration of the American product was competing with three Chinese models on the market.23 This has far-reaching consequences, as DJI’s worldwide dominance of the drone space provides the company with potentially enormous troves of data, and until 2017, their drones were being used by the U.S. armed forces.24

On this issue, the CEO of 3D Robotics said, “I love the idea of other companies making hardware, so we don’t have to and we can focus on the software and services side. We’re a Silicon Valley company and we’re supposed to be doing software and there are Chinese companies that are supposed to be doing hardware.” Unfortunately, while most of the revenue for commercial drones is tied to software and associated services, the fundamental component is the platform and cameras. DJI can partner with any number of analytics providers, because it has a monopoly on the essential segment in the wider technology stack. Belatedly, American and British drone enthusiasts are coming to the realization that Chinese domination of the commercial drone space is a problem, and a number of companies are now pitching themselves as “all-American” in response.

This example shows why Silicon Valley’s unique position as the innovation center of the world is receding. Simply asserting supremacy in software while China dominates hardware and ploughs enormous amounts of investment into R&D is leading America’s technology sectors into irreversible decline. The consumer drone industry should serve as a stark warning to policymakers.

Towards Technology-Based Planning

If the White House’s budget requests for science and technology programs offer any guide, the Trump administration does not consider increased public investment in science programs as a fundamental part of U.S. technology policy. White House requests for big cuts perhaps need to be taken with a grain of salt, as they have been replaced with big increases in congressional appropriations. Nevertheless, the Trump administration has yet to articulate a more comprehensive industrial policy that prioritizes the need to build and maintain dominance in key emerging industries like advanced computing, robotics, quantum technology, etc. This is unfortunate, because it should represent the necessary complement to the moves the administration has made to challenge China’s trade practices, and to encourage capital equipment investment in the 2017 Tax Cuts and Jobs Act. Additional resources are being earmarked for the Defense Department. But without a thriving civil manufacturing and industrial base, the U.S. military advantage will inevitably deteriorate.

There is, however, a precedent for a more robust approach—even for Republicans—arising from the Reagan administration. Throughout the 1980s, the United States was developing something akin to a technology-focused industrial policy. “Project Socrates,”25 as it was called, was the culmination of a Defense Intelligence Agency program headed by physicist Michael Sekora, which sought to achieve two objectives: (1) utilize the full range of intelligence capabilities to determine the underlying causes of America’s declining economic and military competitiveness; (2) use this understanding to develop the needed solutions. Compared to the 1980s, the goals of this project appear far more difficult now.

Among the key elements of the project was that it distinguished between technology-based planning and economy-based planning. While the latter denotes the optimization of funding, the former refers to the effective acquisition and utilization of technology to gain a competitive advantage. This perfectly encapsulates the principles behind Beijing’s “Made in China 2025” plan, which measures success not in terms of GDP but with discrete metrics like gaining self-sufficiency in the production of servomotors for industrial robots, or broader aims like becoming the number one developer of supercomputers.26

Following Reagan’s departure, the end of the Cold War, and the Bush presidency, Project Socrates was labeled an “industrial policy” and discarded, since then only discussed intermittently in obscure corners of the internet. But the time to update and reengage with this approach appears imminent, as the geopolitical situation more and more requires it. Between the Left’s suspicion of technology and the Right’s inertia on economics, the push towards any revitalization of technology-based planning is going to face a long fight.

Cultural Obstacles and Opportunities

No intersection of technology and government is going to be isolated from cultural attitudes and preferences. Venture capitalist Peter Thiel has made this point by juxtaposing the technological advancements of the first half of the twentieth century with the relative stagnation of recent decades, and the cultural attitudes associated with each.27

Establishment thinking on technology and economics since the end of the Cold War was perfectly captured by this paragraph from Wiredmagazine in 1997:

Open, good. Closed, bad. Tattoo it on your forehead. Apply it to technology standards, to business strategies, to philosophies of life. It’s the winning concept for individuals, for nations, for the global community in the years ahead. .28

If openness is to be celebrated, anything perceived as closed must be condemned. This pertains to most expressions of national interest, national technology strategies, and trade policy. As Thomas Friedman once hyperventilated, “Protectionists are dummies, losers, incompetents, hippies, rednecks, dinosaurs, closet socialists, or crypto-fascists, who share more with the mullahs of Iran than bankers on Wall Street.”29

Fast forward to the present, however, and we now face a situation where the fastest growing economies are not open or based on free trade but are consciously mercantilist and nondemocratic. At the same time, the democratic West, which supposedly encapsulates the virtues of openness and connectedness, is in relative, and by some measures absolute, decline. It is a searing indictment of establishment thinking that the values of the Western elite are not being emulated in the developing world, whose leaders increasingly see the state capitalism of East Asia as the way of the future. For liberals who routinely invoke being on the right side of history, this shift is a harsh judgement that they so far show no intent of heeding.

Meanwhile, Western attitudes towards technological innovation itself are changing. Dissatisfaction with Silicon Valley is leading many on both right and left to consider wide-ranging antitrust regulations. At the same time, physical technology like robotics, and the apparently imminent dawn of autonomous trucks and automobiles, is viewed by many as destructive, with some seeking barriers to limit their adoption.

The intellectual and practical unraveling of neoliberalism and neoconservatism has unleashed creative forces on both the left and right that are not so acquiescent to discredited economic orthodoxies, particularly on issues of technology, industry, international trade, and “externalities” such as the environment and the integrity of communities. But while populists on both left and right continue to rise against established elites, they have not yet sufficiently focused on the necessity of having a strategy to compete in the most advanced technologies. Indeed, the prevailing understanding of technology is that it is something largely separate from or oppositional to the state. This is a delusion, and one that has created an unsustainable situation. Failure to reimagine and revitalize the public-private partnerships and wider strategic outlook that helped the United States win the Cold War will make America’s long‑term decline inevitable.

This article originally appeared in American Affairs Volume III, Number 2 (Summer 2019): 25–42.

Notes

1 Brian Alexander, “Why Robots Helped Donald Trump Win,” MIT Technology Review, June 21, 2018.2 Steve Levine, “Robots May Have Given Trump an Edge in 2016,” Axios, July 8, 2018.

3 Melanie Arntz et al., “The Risk of Automation for Jobs in OECD Countries: A Comparative Analysis,” OECD Social, Employment and Migration Working Papers, no. 189 (Paris: OECD Publishing, 2016); L. Nedelkoska and G. Quintini, “Automation, Skills Use and Training,” OECD Social, Employment and Migration Working Papers, no. 202 (Paris: OECD Publishing, 2018).

4 The Ad Hoc Committee on the Triple Revolution, “The Triple Revolution,” Mississippi Freedom School Curriculum.

5 Lawrence Mishel and Josh Bivens, “The Zombie Robot Argument Lurches On,” Economic Policy Institute, May 24, 2017.

6 Mishel and Bivens.

7 Daron Acemoglu and Pascual Restrepo, “Robots and Jobs: Evidence from US Labor Markets,” NBER Working Papers, no. 23285 (March 2017).

8 Acemoglu and Restrepo.

9 Mishel and Bivens.

10 Robert D. Atkinson and John Wu, “False Alarmism: Technological Disruption and the U.S. Labor Market, 1850–2015,” Information Technology and Innovation Foundation, May 2017.

11 Daron Acemoglu et al., “Import Competition and the Great US Employment Sag of the 2000s,” Journal of Labor Economics 34, no. 1, pt. 2 (2016): S141–S198.

12 “North American Robot Shipments Grow Beyond Auto Industry, RIA Says,” Robotics Business Review, February 28, 2019.

13 Oren Cass, The Once and Future Worker: A Vision for the Renewal of Work in America (New York: Encounter Books, 2018).

14 Donald A. Norman, “The Paradox of Capital Investment in the United States,” Aspen Journal of Ideas, May/June 2015.

15 Mark Muro et al., “America’s Advanced Industries: What They Are, Where They Are, and Why They Matter,” Brookings Institution, February 2015.

16 So Chandra, “Broad Gauge of U.S. Factory Productivity Had Record Drop in 2016,” Bloomberg, May 16, 2018.

17 Norman.

18 Norman.

19 Muro et al.

20 Marius Zaharia, “Global R&D Spending Is Now Dominated by Two Countries,” Reuters, April 24, 2018.

21 Susan N. Houseman, “Understanding the Decline of U.S. Manufacturing Employment,” Upjohn Institute Working Paper 18-287, W. E. Upjohn Institute for Employment Research, 2018.

22 “Executive Summary: World Robotics 2018 Industrial Robots,” International Federation of Robotics, 2018.

23 Mike Murphy, “America’s Top Drone Company Couldn’t Beat China’s DJI, so Now They’re Partners,” Quartz, August 1, 2017.

24 Tim Wright, “U.S. Army Puts a Halt to Its Use of Chinese-Made DJI Drones,” Air and Space Smithsonian magazine, August 4, 2017.

25 “The Genesis for the Quadrigy Automated Innovation System Was Project Socrates, a US Intelligence Community Initiative under President Reagan Led by Michael C. Sekora,” Quadrigy (website).

26 Jost Wübbeke et al., “Made in China 2025: The Making of a High-Tech Superpower and Consequences for Industrial Countries,” Merics Papers on China no. 2 (Mercator Institute for China Studies, December 2016), 43.

27 Peter Thiel, “The End of the Future,” National Review, October 3, 2011.

28 Ian Fletcher, Free Trade Doesn’t Work: What Should Replace It and Why (Washington, D.C.: U.S. Business and Industry Council, 2010), 21.

29 Fletcher, 27.